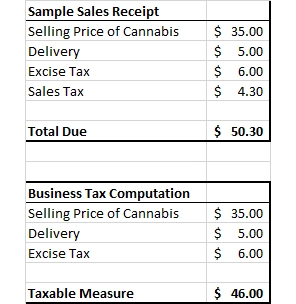

AB 195 changes the application of the State's Excise Tax on cannabis business activity. The new law does not change the City of Los Angeles' tax code or how it is implemented. Consistent with how the City's Gross Receipts Tax has been implemented in the past, receipts collected in order to pay State Excise Tax are considered part of gross receipts, and are taxable under the City's code. The example below shows how this is applied. We've also provided a link to City's Cannabis Tax Compliance Guide for your reference. For further information about the Office of Finance and the City's Business Tax, please visit finance.lacity.org. Please note that the application of the State Excise Tax has changed -- for information, details, and examples of those changes, please see the CDTFA website at https://www.cdtfa.ca.gov/industry/cannabis.htm.

| *Note - All receipts generated from cannabis activity should be included in the calculation of gross receipts. This includes any excise tax, other tax, and fees collected. Only Sales Tax is excluded from Gross Receipts. |

| **Note - The total Excise & Sales Tax shown is for example purposes only. Please see the CDTFA website for Excise & Sales Tax Computation. |