2024 Business Tax Renewal Form Instructions

Blank forms can be accessed here or at our public counters.

The business tax renewal form is broken into seven sections:

- Taxpayer Information

- Tax Incentives & Overpayment

- Tax Worksheet

- Certifications

- Payment Info

- Information Update

- Vendor / Subcontractor / Commercial Tenant Listing

At minimum, all 2024 renewals must verify the information in Section I and complete sections III and IV.

A Note on Timely Filing:

Business Taxes are due January 1st of each year and are delinquent if not paid on or before the last day of February of each year. February 29th, 2024 is the last day for timely filing for 2024 renewals. All 2024 payments received at any of our branch offices by 4:00 P.M. on February 29th, postmarked by the U.S. Post Office, or filed electronically no later than 11:59 P.M. on February 29th, are considered timely.

If you have questions about your renewal, please do not wait until the end of February to file. Due to the volume of inquiries, appointments and walk-ins at the public counters may be unavailable, and calls and emails may experience extended response delays. If you are unable to get a response to your question and do not file before the deadline, you may be assessed interest and penalties.

Timely filing requires timely payment of any tax due. If you have tax due, please ensure that your payment method is valid, as returned checks and rejected credit card or e-check payments may also result in assessment of interest, penalties and returned item fees, even if you filed the form or completed the online renewal before the deadline.

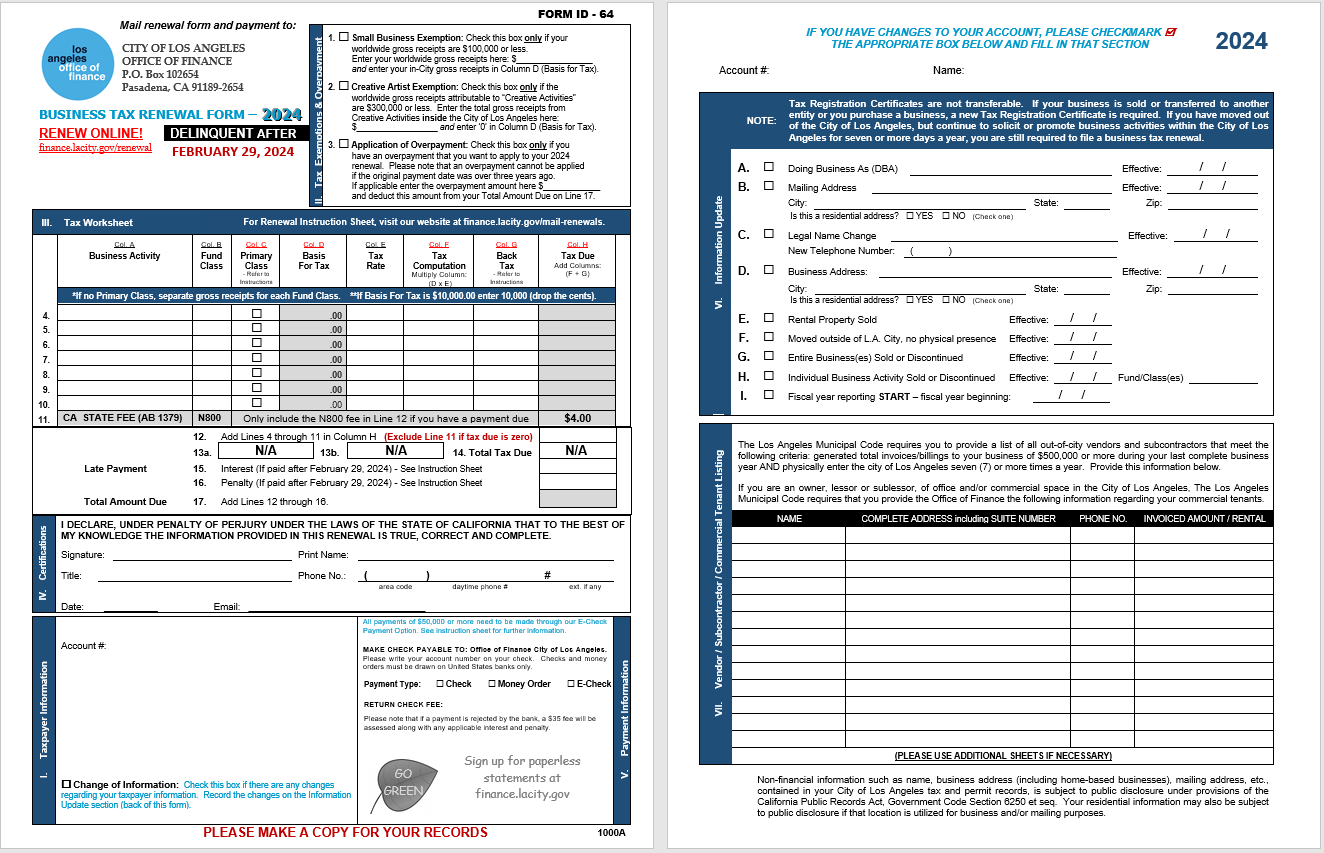

Section I - Taxpayer Information

The Taxpayer Information section should be completed with the Account Number, current Legal Name, DBA (if applicable) Business Address and Mailing Address that the City of Los Angeles has on file for your business.

If you received a pre-printed form that contains your account information, please review it to ensure the information is accurate. If you are using a blank form, please provide your Account Number, Legal Name, DBA (if applicable), Business Location Address, and Mailing Address.

If you need to update any of the taxpayer information the Office of Finance has on file for your business, please check the Change of Information box and report changes or corrections on Section VI - Information Update, on the other side of the renewal form.

You should also check the Change of Information box and complete Section VI if you have sold rental property, the business was either entirely or partially sold or discontinued, or would like to renew based on a fiscal year and need to report the beginning month of your fiscal year cycle.

If you purchased your business from the owner shown on this renewal form, please contact one of our offices listed here.

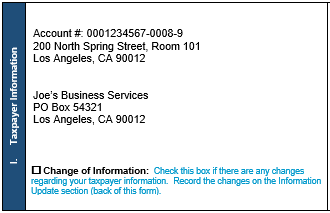

Section II - Tax Exemptions and Overpayment

This section includes steps for the Small Business Exemption, Creative Activities Exemption and Application of Overpayment.

- Small Business Exemption: The City of Los Angeles provides a small business exemption to businesses that have worldwide gross receipts that did not exceed $100,000 for the 2023 calendar year. You must file/postmark your renewal by February 29, 2024 in order to receive the exemption. If you meet the gross receipts requirement and are filing before the deadline, check the box on line 1 and enter your worldwide gross receipts on the space provided. Then input your receipts from activities within the City of Los Angeles in Section III, Column D.

Creative Artist Exemption: The City of Los Angeles provides an exemption to taxpayers that have worldwide gross receipts from “Creative Artist” activities that did not exceed $300,000 for the 2023 calendar year. You must file/postmark your renewal by February 29, 2024 in order to receive the exemption. If you meet the gross receipts requirement and are filing before the deadline, check the box on line 2 and enter your gross receipts from Creative Artist activities within the City of Los Angeles in the space provided. Then enter “0” on the corresponding line in Section III, Column D.

Those who may be eligible for this exemption are: actor/announcers; art directors, costume designers, production designers, scenery/set designers; choreographers; cinematographers; musical conductors; directors; motion picture editors; sound dubbing, special effects, or titling artists; creative writing; music/lyrics arrangers, composers, or writers, authors; cartoon artists; lithographers/painters/sculptors of visual fine arts; drawing, graphic, illustration or sketch artists; and photographers (if primarily artistic and not journalistic or commercial). Please refer to LAMC §21.29(b) for more complete definitions or descriptions.

A "Creative Artist" may operate in any of these business arrangements and still be eligible for the exemption:

- As an individual

- Through a corporation with one individual as the only shareholder and the only employee

- Through a limited liability company with one individual as the only member and the only employee

- Application of Overpayment: If you have an overpayment from a prior tax period and would like to apply this overpayment to reduce your 2024 tax liability, check the box on line 3 and enter the amount of overpayment you would like to apply. Then deduct this amount from the Total Amount Due on Line 17. Please note that prior-period overpayments can only be applied to current tax liability within three years of the original overpayment.

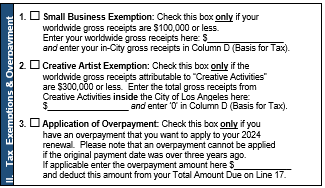

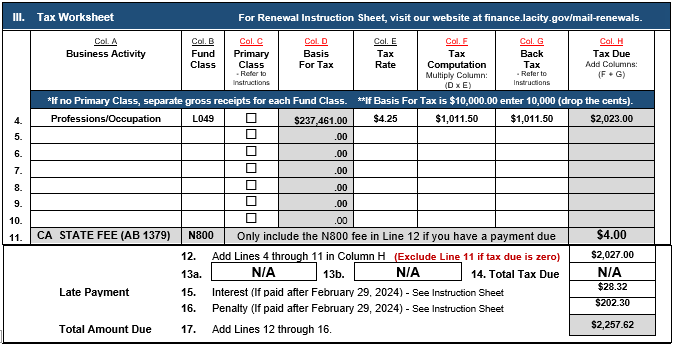

Section III - Tax Worksheet

This section is where you will report your tax measure (for most businesses this will be gross receipts) for each business activity during 2023 and calculate the tax due for 2024. Each activity should be reported on one line, from Line 4 to Line 10, with the calculation for each activity going across from Column A to Column H.

Column A – Business Activity: This column shows all of the taxable business activities your business is engaged in.

- If you are using a pre-printed form, your business activities will be listed here already.

- If you are engaged in a business activity not listed on the renewal form or are using a blank renewal form, provide a short description of the business activity on lines 4-10.

- If you are still in business but have ceased one or more of the activities listed, or if you are no longer in business, check the Change of Information box in Section I and complete Section VI, line G or H with the effective date and fund class or classes to cancel.

Column B – Fund/Class: Column B lists the fund/class codes that correlate to each taxable business activity listed in Column A. The list of available Fund/Classes can be found in the business tax rate charts available here. Pre-printed forms will have the fund/class already shown. If you are using a blank form, please input the appropriate fund/class for each corresponding activity.

Column C – Primary Class: If you have 2 or more business activities listed in Column A for which the "Basis for Tax" is gross receipts, and one activity generated at least 80% of your taxable gross receipts in 2023, you may consolidate all your gross receipts and report them under the Primary Class by checking the appropriate box in Column C. You may only select one Primary Class. If electing to consolidate, leave columns D, F and H blank for the activities which were not selected as the Primary Class. For more information on Single Primary Tax Classification Election, please refer to §21.06.1 of the LAMC.

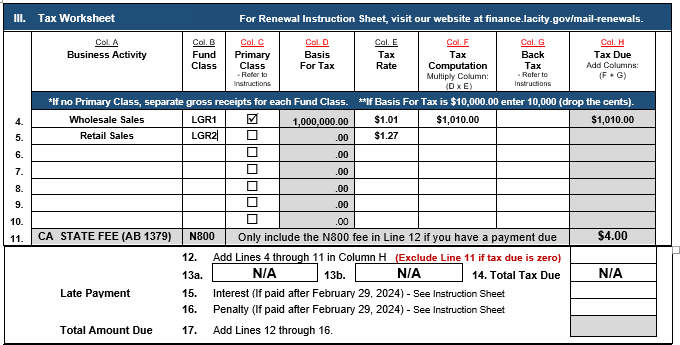

The following example assumes a wholesale and retail business that had gross receipts in 2023 of $1,000,000.00. $800,000.00 was attributed to wholesale activities and $200,000.00 was attributed to retail activities. Since the wholesale business generated 80% of all taxable gross receipts from 2023, the business would be entitled to elect wholesale as its primary class and take advantage of the lower tax rate for wholesale activities.

Column D – Basis for Tax: This column is where you will provide the basis for tax for each of your business activities (or just your primary activity if you selected one in Column C).

The Fund/Class for each activity determines the manner in which the activity is taxed. Most business activities are taxed based on gross receipts. However, some activities are taxed based on other factors. The table below describes the manner in which the various fund/classes are taxed.

Fund/Class | Basis for Tax |

|---|

L055, L094, L108 | Flat Rate |

L062 | Number of Tables |

L063, L064, L265, L763 | Number of Machines |

L070 | Number of Alleys, Machines, Tables and Courts |

L109, L309. L142, L188

L193, L194, L195, L196 | See Worksheet |

All Other Funds/Classes | Gross Receipts |

The term "gross receipts" is defined as gross receipts (including reimbursed expenses) from the previous calendar year or your previously designated fiscal year reported on an accrual or cash basis in accordance with Internal Revenue Service (IRS) guidelines. If reporting on an accrual basis, you may exclude from your reportable gross receipts any uncollectible amount ("bad debt") apportioned to the City of Los Angeles that has been written off as a "bad debt" in compliance with IRS guidelines. Any portion of "bad debt" subsequently recovered by a taxpayer shall constitute taxable gross receipts in the year that it is recovered. Gross receipts associated with certain activities may be excluded from the basis for tax for businesses conducting only part of their activities within the City of Los Angeles or whose gross receipts include amounts received from or paid to a related entity. Refer to LAMC §21.00(a) for more detailed information regarding taxable gross receipts. Refer to the tax information booklet for information regarding apportionment of gross receipts.

If the basis for tax is not gross receipts, please enter the appropriate number based on the basis for tax listed in the table above or the worksheet, whichever is applicable.

Small Business Exemption - If you meet the requirements for the Small Business Exemption and checked the box on line 1, enter your gross receipts from business activities within the City in Column D.

Creative Artist Exemption - If you meet the requirements for the Creative Artist Exemption and checked the box on line 2, then do one of the following:

- If all gross receipts in the Professions/Occupations category (Fund/Class L049) are derived from "Creative Artist” activities, enter "0" in Column D on the line for that activity.

- If you have gross receipts in the Professions/Occupations category (Fund/Class L049) from other activities in addition to those derived from "Creative Activities", enter the taxable gross receipts (gross receipts not attributable to creative artist activities) in Column D.

Column E – Tax Rate: This column shows the rate of tax for the corresponding activity. If you are using a preprinted form, the correct rates should be printed in Column E. If you are using a blank form or adding a new business activity, you can find tax rates from our Tax Rate Tables. If you see "WKST" in Column E or are renewing for business activities requiring a specialized worksheet, please go to the appropriate supplemental worksheet to calculate the tax. You can find these worksheets here.

Column F – Tax Computation: This column is where you calculate the tax for each business activity.

For business activities with gross receipts as the basis for tax, the tax is the rate shown in Column E per one thousand dollars ($1,000) of gross receipts or fractional part thereof. To calculate the tax, follow these steps:

- Round up total gross receipts shown in Column D to the next $1,000.

- Divide by $1,000 (because tax rates as shown are “per $1,000”).

- Multiply the result by the rate in Column E.

- Enter the result in Column F.

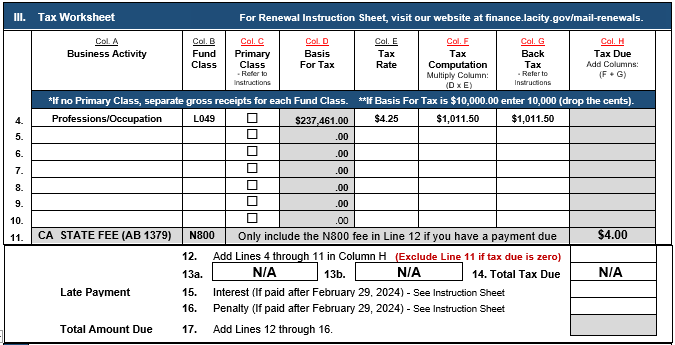

The following example shows a business in the Professions/Occupations activity. Total gross receipts of $237,461 would be rounded up to $238,000. The tax would then be calculated as 238 multiplied by $4.25 (the applicable tax rate) for a tax computation of $1,011.50.

For business activities with non-gross receipts basis for tax (excluding business activities subject to a flat fee), simply multiply Column D by Column E, then enter the result in Column F.

Column G – Back Tax: This column only applies to businesses or activities that began in 2023. Copy the amount from Column F into Column G, unless "N/A" is printed in Column G. Back Tax reflects the tax due for the prior year, since most businesses do not pay tax in their first year of operation.

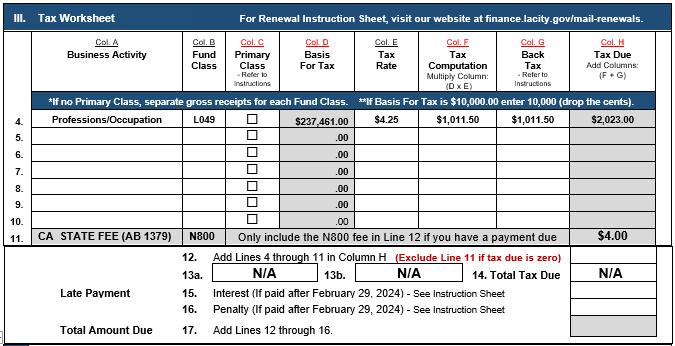

Using the same business as above, this example shows input of back tax in Column G.

Column H – Tax Due: This column shows the amount of tax that is due for each business activity. Add the amounts in Column F and Column G, then enter the result in Column H.

Small Business Exemption - If you meet the requirements for the Small Business Exemption and checked the box on line 1, enter “0” in Column H.

Creative Artist Exemption - If you meet the requirements for the Creative Artist Exemption and checked the box on line 2, then do one of the following:

- If all gross receipts in the Professions/Occupations category (Fund/Class L049) are derived from "Creative Artist” activities, enter "0" in Column H on the line for that activity.

- If you have gross receipts in the Professions/Occupations category (Fund/Class L049) from other activities in addition to those derived from "Creative Activities", calculate the tax as described above and enter the result in Column H.

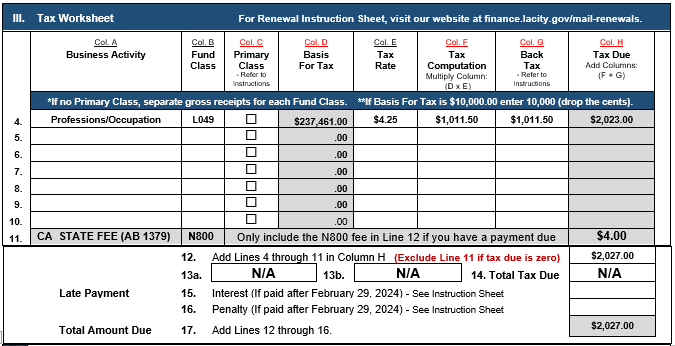

Again using the same business as above, this example shows the input of tax due in Column H.

Line 11 – California State AB 1379 Fee: If you have a payment due, the State of California requires an additional fee of $4.00 be added to the amount due. These funds are remitted to the State to increase disability access and compliance with construction-related accessibility requirements.

Line 12: This is the total of the amounts in Column H for lines 4 through 10, plus the $4.00 in line 11 if any of the other lines have an amount due.

The example below shows the completed Section III if the business files its renewal by February 29, 2024. The total due, shown on both Line 12 and Line 17, is $2,027.00.

Line 13/14: This line is for use only by multimedia businesses located in the Hollywood and North Hollywood Redevelopment Areas.

Multimedia businesses located in the Hollywood/North Hollywood redevelopment areas have tax liability limited to $25,000 plus 10 percent of the amount in excess of $25,000. If the amount due in line 12 is less than $25,000, simply copy that amount into box 14. If the amount in line 12 is greater than $25,000, follow these steps:

- Subtract $25,000 from the amount on line 12 and put this amount in box 13a.

- Multiply the amount in box 13a by 10% (0.1) and put this amount in box 13b.

- Add $25,000 to box 13b and put the total in box 14.

Line 15 – Interest: If you are filing your renewal after February 29, 2024, interest is due in addition to the tax.

Interest accrues at the rate of 0.7% per month applies as of March 1, 2024 and continues accruing the first day of each month thereafter until paid. Interest applies only to the amount of principal tax due. To calculate interest, multiply the tax due (the total of Column H lines 4 through 10) by 0.007 and multiply that amount by the number of months delinquent. Enter this amount on Line 15.

Example (Using the same figures from the example business above), if the business files on April 15, 2024:

Date Filed | Interest Rate | Months Delinquent | Principal | Interest Due |

|---|

04/15/2024 | 0.7% | 2 | $2,023.00 | $28.32 |

Line 16 – Penalty: If you are filing your renewal after February 29, 2024, a penalty is due in addition to the tax. The penalty ranges from 5% to 40% of the amount of unpaid tax, based on when you file, as follows:

5% applies as of March 1, 2024; 10% as of April 1st; 15% as of May 1st; 20% as of June 1st; and 40% as of July 1st. To calculate the penalty, multiply the tax due (the total of Column H lines 4 through 10) by the appropriate percentage based on the filing date. Enter this amount on Line 16.

Example (Using the same figures from the example business above), if the business files on April 15, 2024:

Date Filed | Penalty Rate | Principal | Penalty Due |

|---|

04/15/2024 | 10% | $2023.00 | $202.30 |

If the example business from above files on April 15, 2024 instead of by February 29, 2024, their Section III Tax Worksheet will look like this, with a Total Amount Due of $2,257.62.

Line 17 – Total Amount Due: Add lines 12 through 16 (or 13 through 16 if filing as an eligible Multimedia Business in Hollywood or North Hollywood) and enter the result on line 17. This is the total amount due to the City of Los Angeles for your Business Tax Renewal.

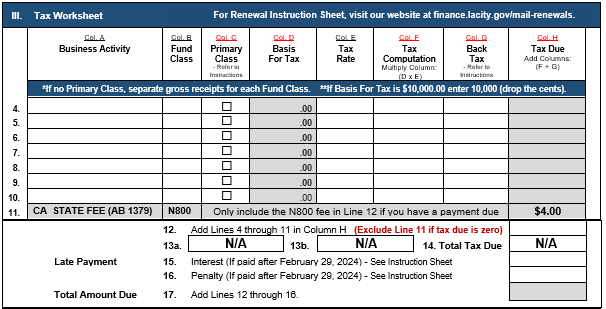

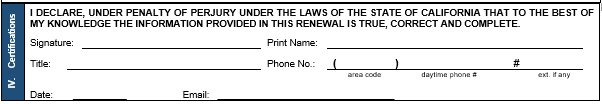

Section IV - Certifications

The owner, partner, or officer must sign and print their name. Indicate your title and daytime phone number, with extension if applicable. Enter the date and provide an email address where the City may contact you.

Section V - Payment Information

If payment is due, please check the appropriate box corresponding to the method of payment you will be using. Only one form of payment is allowed.

If paying by check or money order, please write your account number on the check or money order, and make it payable to:

Office of Finance City of Los Angeles

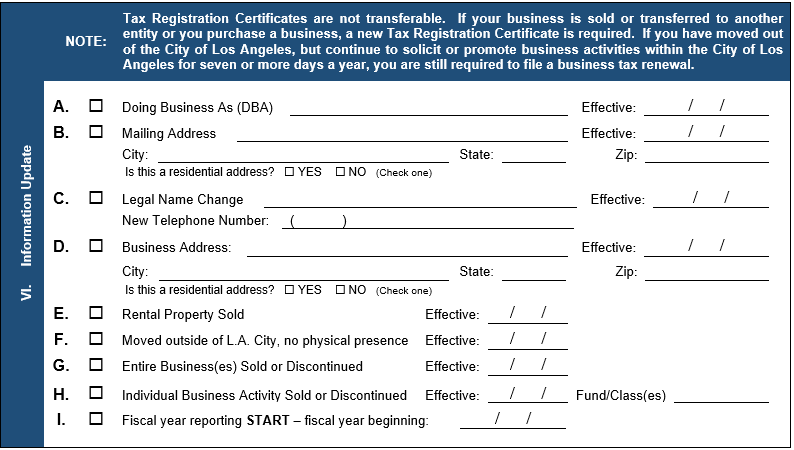

Section VI – Information Update

Use this Section to update your information on file with the Office of Finance. If you need to use this section, please remember to check the “Change of Information” Box below your mailing address in Section I.

Business Tax Registration Certificates are not transferable. If you purchase an existing business from another person or entity, you must apply for a new Certificate. You can apply for a new Certificate here. Similarly, if you sell or transfer your business to another person or entity, they will need to apply for a new Certificate.

Note that non-financial information including name, DBA, business address, mailing address, and primary business activity, collected from your original application and any updates you provide, is subject to public disclosure under provisions of the California Public Records Act. This includes your residential information if that location is used as the business or mailing address. Non-financial information about active registered businesses is also published on the City’s website here.

- Doing Business As (DBA): If you are doing business under a name different than your business’ legal name, you need to register your fictitious name with the State of California. Once you have done this, you can check the box on Line A and add your DBA to your Business Tax account. Please include the effective date, and enclose a copy of the DBA registration for our records.

- Mailing Address: If you are changing your business’ mailing address, provide it here. Please also note if this mailing address is a residential address by checking the appropriate box.

- Legal Name Change: If you have changed the legal name of your business, provide the new name here. Please include the effective date of the change and enclose documentation confirming the change.

- Business Address: If your business has moved to a different location, provide the new address here. Please include the effective date of the change and note whether the new address is a residential address by checking the appropriate box.

- Rental Property Sold: If your business activity is property rental and you have sold the property, provide the effective date of the sale. If you have multiple rental properties under the same account, please provide the address of the rental property sold.

- Moved Outside of Los Angeles: If your business has moved outside of the City of Los Angeles and no longer does business within the City, provide the date of the move here. Please note: if you continue to solicit or promote your business within the City or enter the City for business more than seven days a year, you are still required to maintain a Business Tax account. If this is the case, do not check box F. Instead, check box D and provide the new business address there.

- Entire Business Sold or Discontinued: If you have sold or discontinued your entire business, provide the effective date here. Once any outstanding tax liability is paid, your account will be closed.

- Individual Business Activity Sold or Discontinued: If your business is registered for multiple business activities but you have sold or discontinued one or more of them, please provide the effective date and the impacted fund/class(es).

- If you would like to report your tax measures on a fiscal year reporting basis rather than a calendar year reporting basis, enter the start date of your fiscal year on this line.

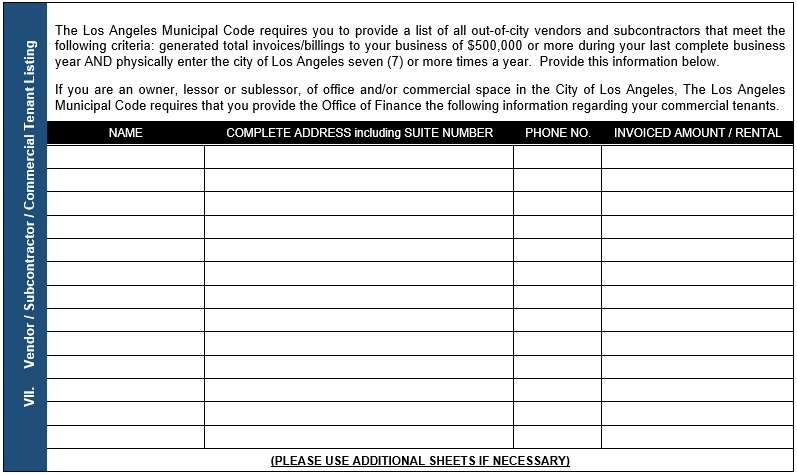

Section VII – Vendor / Subcontractor / Commercial Tenant Listing

This section has two purposes:

- Businesses must provide a list of all vendors and subcontractors that generated more than $500,000 in invoices or billings to your business AND physically entered the City of Los Angeles more than seven times during the year.

- Owners, lessors, and sub-lessors of office and/or commercial space in the City of Los Angeles must provide a list of their tenants.

Please use the lines on the form to provide the required information for whichever purpose applies to your business, or both if applicable.

Submitting your Renewal

Make a copy of your completed renewal form to retain for your records. If mailing your form, please ensure that your payment is enclosed and mail the original with required signatures to the following address:

City of Los Angeles

Office of Finance

P. O. Box 102654

Pasadena, CA 91189-2654

The renewal MUST BE POSTMARKED NO LATER THAN MIDNIGHT on February 29th, 2024. Your canceled check or ACH confirmation is your receipt if payment is due. Proof of mailing is highly recommended.

A new Business Tax Registration Certificate will not be mailed to you unless changes or corrections were required. The certificate you have remains valid unless it is suspended or revoked.

If you have questions about how to complete this form, or any other City of Los Angeles tax issues, please contact the Office of Finance at finance.customerservice@lacity.org or call us at (844) 663-4411. Please note that call and email volumes are very high during the February renewal season, so if you have questions you need answered in order to complete your annual renewal you should contact us as soon as possible.